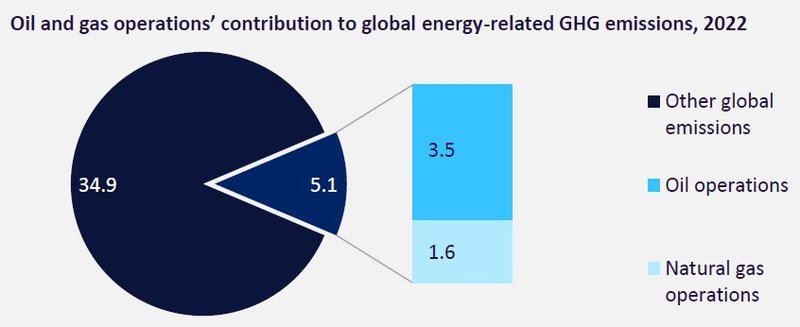

Oil and gas (O&G) operations, and the end of the sector’s products, are both significant contributors to global emissions. Greenhouse gas (GHG) emissions generated by oil and gas operations—also known as Scope 1 and 2 emissions—accounted for 15% of total energy-related emissions worldwide in 2022. A further 40% of energy-related emissions came from the use of oil and gas for power generation, heating, vehicle fuel, and industrial processes, also known as Scope 3 emissions.

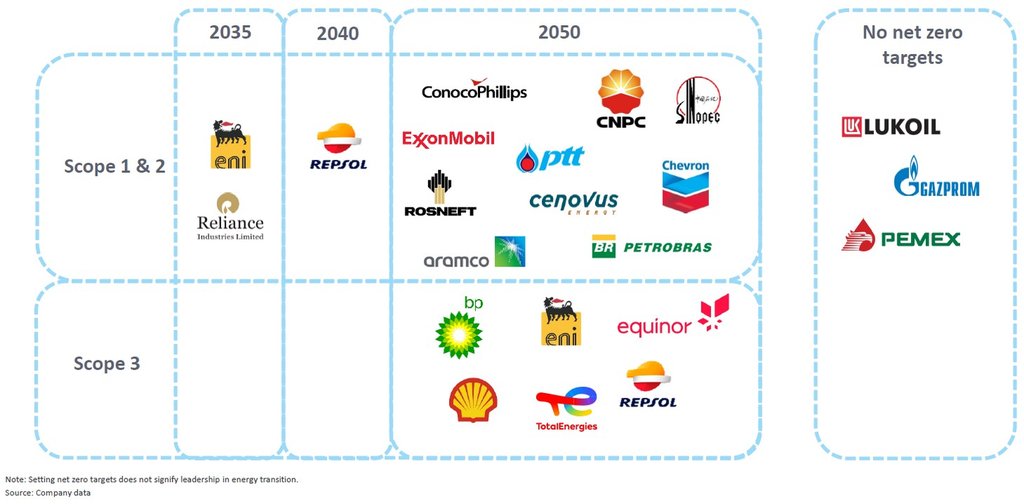

The leading 20 oil and gas companies analysed by GlobalData have announced strategies for cutting emissions. Nearly all have set net-zero targets for 2050 except for four: Lukoil, Gazprom, Pemex, and CNPC (which has a target for ‘near zero’ emissions by 2050).

Most net-zero targets set by oil and gas companies cover Scope 1 and 2 emissions. Six companies have targets covering Scope 3 emissions. No targets set by the 20 largest oil and gas firms have yet been approved by the science-based targets initiative (SBTi), the verifier of corporate emissions targets, which is still developing its oil and gas methodology.

Oil and gas companies face regulatory pressure to cut emissions, with governments using a combination of regulation and investment to drive decarbonization.

Who is winning the race to net zero?

Most O&G majors have set net zero targets, but few include Scope 3 emissions. Only six companies have set net zero targets covering Scope 3 emissions. No targets have yet been verified by the SBTi.

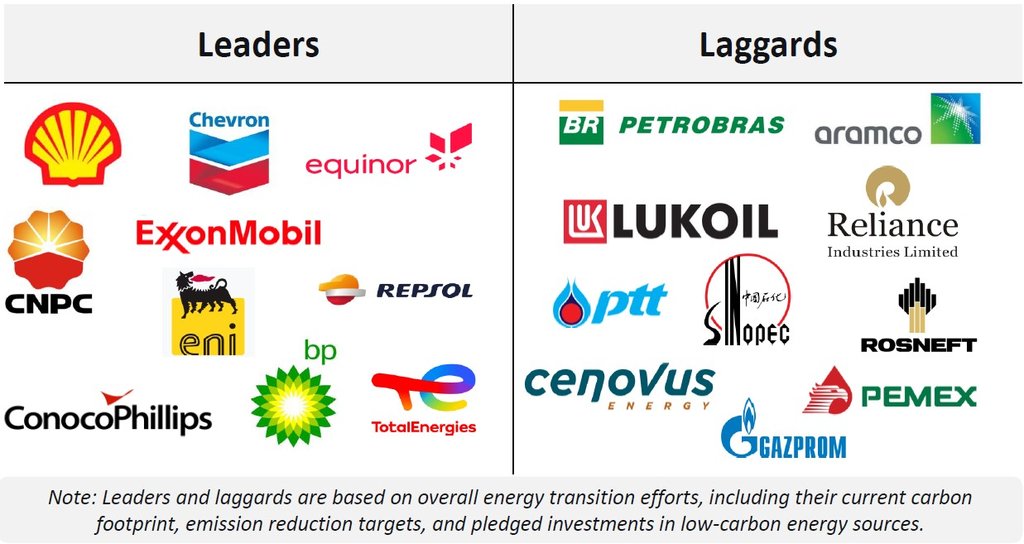

Shell and BP lead the energy transition race, according to GlobalData’s Energy Transition ranking, which compares companies’ emissions performance and progress in key strategies. Aramco, the largest O&G company, ranks low, but it is investing more in renewable capacity and reduced flaring. The leading companies based on GlobalData’s Energy Transition ranking are shown below.

M&A as a key net zero strategy for leading companies

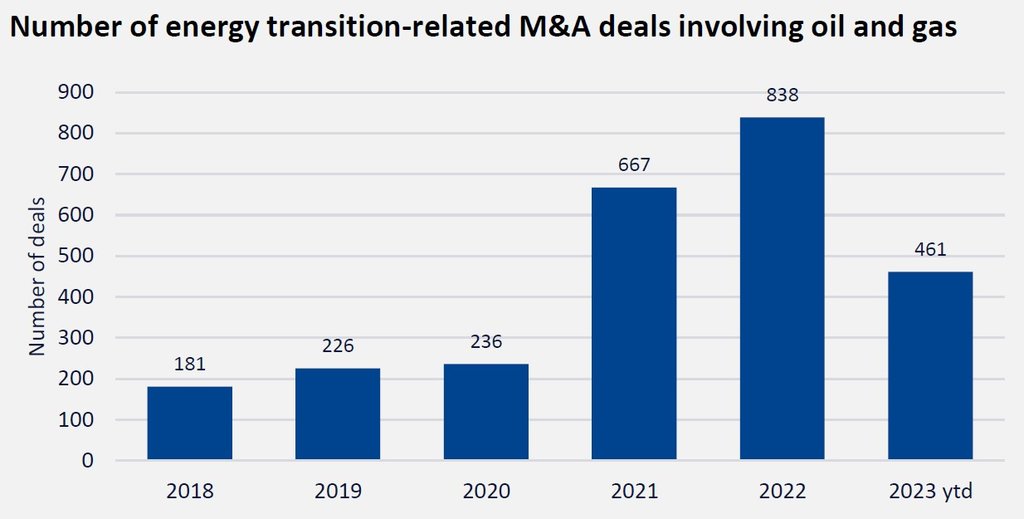

Energy-transition-related M&A deals more than tripled from 2020 to 2022. Some of the largest acquisitions include BP’s $4.1 billion acquisition of Archaea Energy, a renewable natural gas producer, in 2022. In the same year, Chevron acquired Renewable Energy Group, a producer of bio-based diesel, for$3.15 billion.

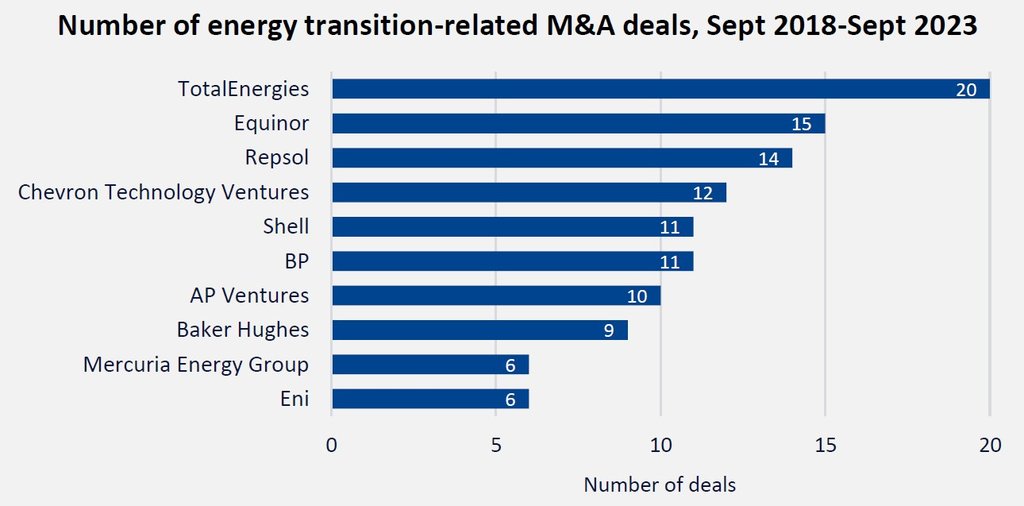

TotalEnergies has been the most prolific acquirer in terms of deal numbers. Its deals include the acquisition of the business and commercial units of solar developer SunPower for $250m in 2022. Also in 2022, it planned to invest $4 billion in a joint green hydrogen project with Adani Group, but the deal was put on hold.

Some companies have also divested some of their high-emitting assets. For example, BP’s sale of its Alaska business in 2019 reduced its upstream emissions.

O&G operations generate 15% of global energy-related emissions

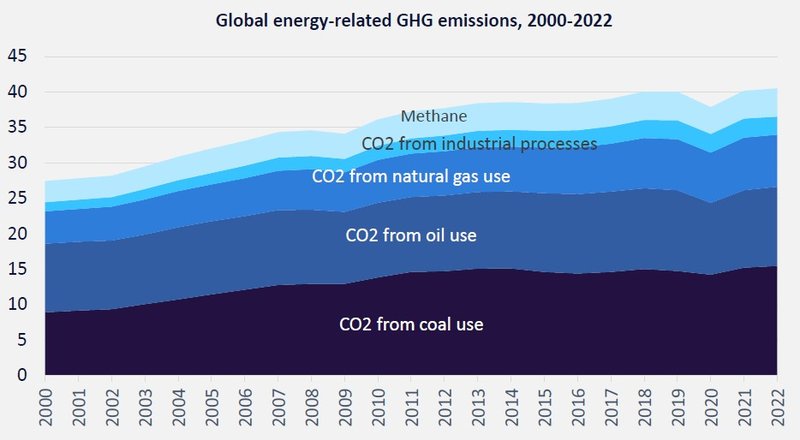

Global energy-related GHG emissions reached an all-time high of 41.3 gigatons of CO2e* in 2022, according to the International Energy Agency (IEA). Oil and gas operations (Scope 1 and 2 emissions) accounted for 5.1 gigatons of these emissions, equivalent to 15% of total energy-related emissions. The use of oil and gas by end users (Scope 3 emissions) contributes a further 40% of total emissions.

The US has the highest CO2 emissions from oil and gas operations.

Methane is a significant GHG across natural gas and oil production. The oil and gas industry requires a large energy input due to the intensive nature of drilling, extracting, processing, and refining. Operational emissions intensity for natural gas production is predominantly driven by the release of methane. Methane is also a significant component of emissions intensity in oil production alongside refining.

Scope 1 and 2 emission reduction strategies

Upstream, a significant source of emissions is platform power generation. Flaring and venting also contribute a significant component. A large volume of GHGs comes from gas processing and LNG operations, such as during the removal of acidic gases before natural gas transportation or during liquefaction.

Diverse initiatives are being considered to reduce carbon footprint, and quick progress is being made on tackling upstream and downstream emissions. But the switch to low-carbon products is a longer-term process, with many oil and gas majors in the very early stages of their energy transition strategy.

To reduce Scope 1 and 2 emissions, oil and gas companies are reducing their gas flaring and leakage, investing in carbon capture and storage, and powering platforms with renewables. Many companies are using, or plan to use, carbon offsets to mitigate operational as well as value chain emissions. Several oil and gas majors have already put their operational emissions on a downward path.

Here are some of the key strategies being used to cut Scope 1 and 2 emissions.

Upstream emissions

- Powering offshore platforms using cleaner grid power or on-site renewables, like offshore wind farms, e.g. Equinor and ExxonMobil

- Flaring reduction, e.g., Eni

- Carbon capture for permanent sequestration or reinjection to increase production, known as enhanced oil recovery (EOR), e.g., ExxonMobil

Downstream emissions

- Using blue or green hydrogen in refineries, e.g., BP and Shell

- Adoption of electrification for some heat processes, e.g., Shell and Repsol

- Utilization of waste heat from industrial processes, e.g., Chevron and ExxonMobil

- Capturing CO2 for use in the production of e-fuels and renewable fuels, e.g., Equinor and TotalEnergies

GlobalData’s thematic analysts discuss the current state of sustainability commitments in the power, oil & gas, and mining sectors, and how companies are working to reduce their environmental impact.

Scope 3 emission reduction strategies

For the top 18 oil and gas companies that report Scope 3 emissions figures, Scope 3 makes up 75% of their average emissions. This means that even if oil and gas companies reduce GHG emissions from their operations, their sales are still at risk from net zero mandates.

Most oil and gas net zero targets are focused on operational emissions, which includes Scope 1 and 2. Pivoting net zero strategies to address Scope 3 emissions typically requires investing in cleaner sources of energy.

Methane constitutes a large slice of operational emissions in natural gas production—57% according to the IEA. This is because while a smaller volume of methane is released, it has a higher warming potential. One ton of methane is equivalent to 30 tons of CO2 based on its 100-year warming potential.

To reduce Scope 3 emissions, oil and gas companies are switching their products to lower-carbon sources of energy including hydrogen, liquefied natural gas (LNG), biofuels, and renewables. They are doing this through organic developments and acquisitions, with energy transition-related deal activity climbing rapidly over the last three years. Most oil and gas majors are in the very early stages of their energy transition strategy.

Here are some of the key strategies being used to cut Scope 3 emissions:

- Decreasing oil and gas sales via divestment of assets or decreasing production, e.g., TotalEnergies

- Production of low-carbon fuels such as biofuels, sustainable aviation fuels, and blue or green hydrogen, e.g., Eni and Shell

- Use of offsets and carbon capture technologies, e.g., BP and CNPC

GlobalData, the leading provider of industry intelligence, provided the underlying data, research, and analysis used to produce this article.

GlobalData’s Thematic Intelligence uses proprietary data, research, and analysis to provide a forward-looking perspective on the key themes that will shape the future of the world’s largest industries and the organisations within them.