Deals in the oil and gas sector were led by EQT’s $5.2bn asset transaction with THQ Appalachia I and Xcl Midstream, according to GlobalData’s deals database.

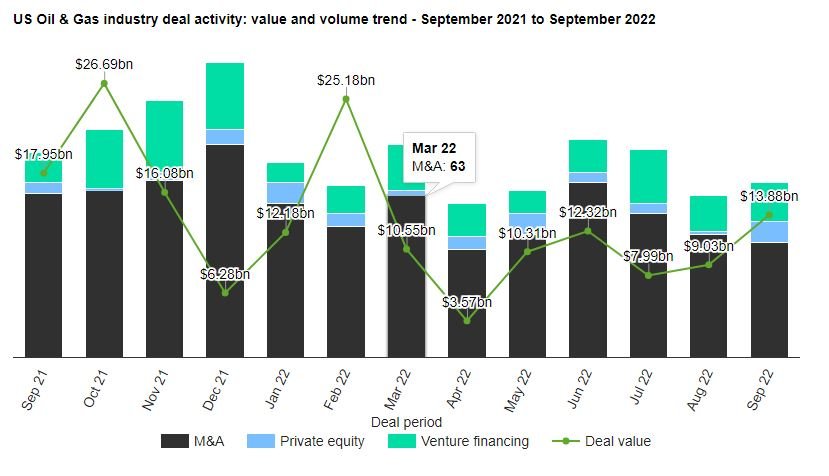

A total of 68 deals worth $13.9bn were announced in September 2022, compared with the 12-month average of 81 deals. Mergers and acquisitions (M&A) was the leading category in the month in terms of volume with 45 deals, which accounted for 66.2% of all deals.

In second place was venture financing with 15 deals, followed by private equity with eight transactions, respectively accounting for 22.1% and 11.8% of overall deal activity in the US technology industry during the month. In terms of value of deals, M&A was the leading deal category in the US oil and gas industry with total deals worth $13.4bn, while private equity and venture financing deals totalled $400m and $99.5m respectively.

The top five oil and gas industry deals accounted for 81.6% of the overall value during September 2022. The combined value of the top five oil and gas deals stood at $11.3bn, against the overall value of $13.9bn recorded for the month.

The top five deals were:

1) EQT’s $5.2bn asset transaction deal with THQ Appalachia I and Xcl Midstream

2) The $2bn acquisition of Mobil California Exploration and Producing Asset by IKAV Capital Partners

3) IKAV Capital Partners’s $2bn acquisition deal with Shell Onshore Ventures

4) The $1.1bn acquisition of EnVen Energy by Talos Energy

5) The $1bn merger deal with Decarbonization Plus Acq IV and Hammerhead Resources